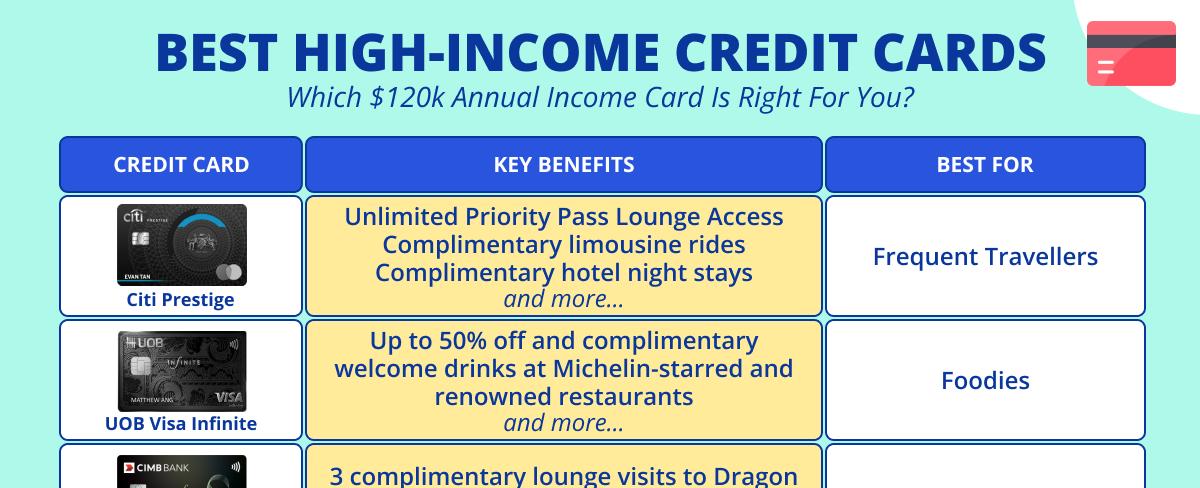

Best Credit Cards For High-Income Earners (120K Annual Income): Which Card Is Right For You?

Are you a high-income earner with an annual income of $120,000 or more? If so, then choosing the right credit card can help you maximize your rewards, earn cash back, and enjoy exclusive perks tailored to your lifestyle. In an informative article titled “Best Credit Cards For High-Income Earners: Which Card Is Right For You?” our experts have reviewed and compared the best credit cards available to high-income earners.

The article highlights top credit cards, such as the American Express Platinum Card, which offers exclusive access to airport lounges, concierge service, and up to $200 annual travel credit. The Chase Sapphire Preferred Card is another great option, with its generous rewards program - 2x points for travel and dining, and a 25% bonus on points earned when redeemed through Chase Ultimate Rewards.

The article also discusses alternatives, such as the Capital One Venture Rewards Credit Card, the Citi Double Cash Card, and the Discover it Miles Card—all of which offer their own unique perks and rewards programs.

As a writer for a news site, I know firsthand how important it is to make informed decisions when it comes to financial matters. Choosing the right credit card can help high-income earners save money, earn rewards, and enjoy exclusive perks that suit their lifestyles.

In conclusion, if you’re a high-income earner, it’s essential to compare different credit cards, evaluate their perks and rewards, and choose the one that best suits your needs. By doing so, you can maximize your benefits and make the most of your money.

Quick Links