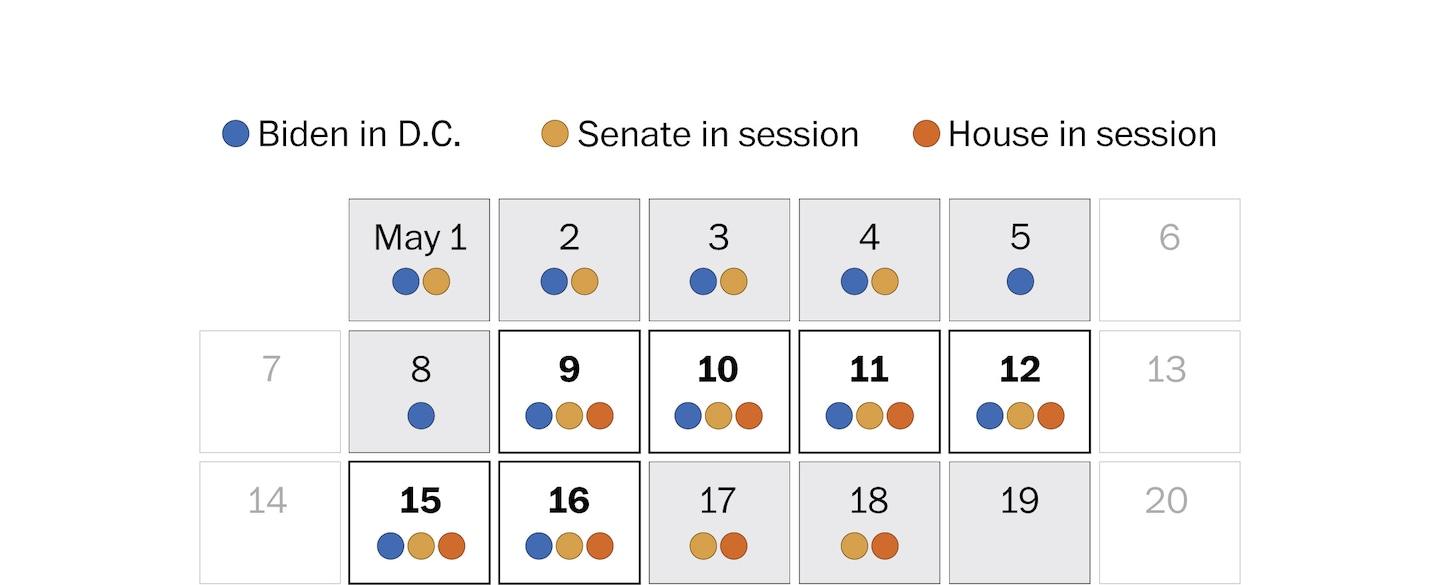

Biden, Congress running out of work days to strike a debt ceiling deal

The United States Congress and the Biden administration are rapidly running out of time to figure out how to pay the country’s bills without the government defaulting on its loans. The looming debt ceiling crisis has been exacerbated by a number of factors, including the COVID-19 pandemic and an increase in government spending. Despite being warned about the approaching deadline, Republican lawmakers are refusing to cooperate with Democrats on a plan to raise or suspend the debt ceiling. Treasury Secretary Janet Yellen warned earlier this month that if Congress does not act soon, the country will be unable to meet its financial obligations by mid-October. This would lead to an economic catastrophe that would ripple throughout the global financial system. Additionally, it would further destabilize the country’s already shaky recovery from the pandemic. With only a handful of working days left before the deadline, the pressure is on Congress to take action. Many Americans are understandably worried about the impact of a government default on their own financial security. As the situation continues to develop, it’s likely that it will remain a hot topic for some time to come.

Quick Links