Citizens Insurance seeks double-digit rate increase on home insurance policies

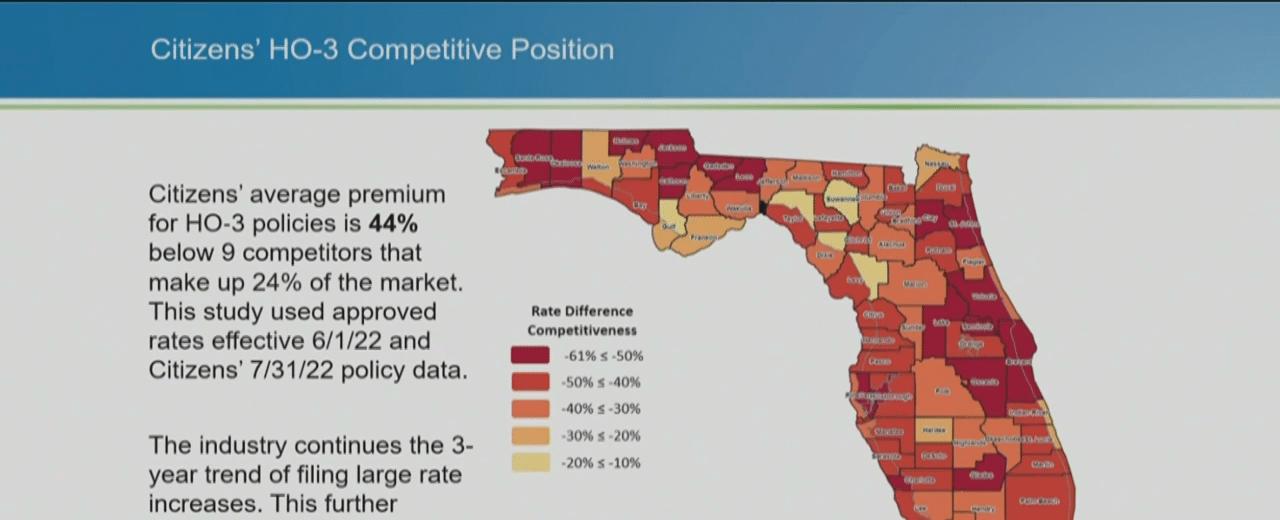

It looks like homeowners in Florida may soon have to pay more for their insurance policies. According to a recent article titled “Citizens Insurance seeks double-digit rate increase on home insurance policies”, the state-run company is requesting a 3.2% rate increase for personal lines homeowners insurance policies. This is on top of last year’s rate hike of 7.2%. If the higher rates are approved, policyholders could see their rates increase by double digits, which could be a tough pill to swallow for those already struggling financially.

Why should you care? Well, if you’re a homeowner in Florida, you could be directly impacted by this rate increase. And if you’re not, it’s still worth paying attention to, as it highlights the ongoing issue of skyrocketing insurance rates across the country. As natural disasters become more common and more severe, insurance companies are increasing rates to make up for their losses. However, these rate hikes can put a strain on already struggling homeowners, which is why it’s important to stay informed on the issue.

In conclusion, homeowners in Florida should keep an eye on the potential rate increase from Citizens Insurance. It’s just another example of the challenges facing homeowners across the country as insurance rates continue to rise. By staying informed, you can make more informed decisions when it comes to your own insurance policies.

Quick Links