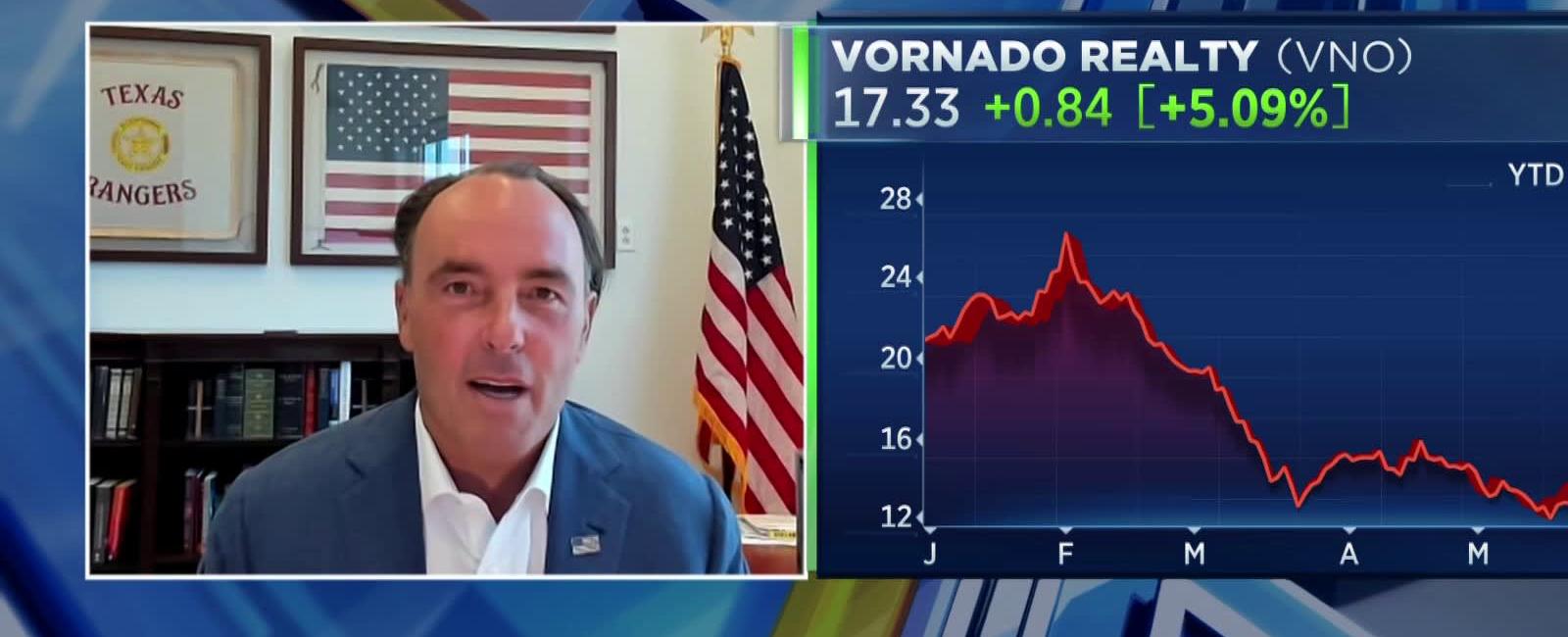

Hayman Capital's Kyle Bass: Taking debt out of the equation is key to a value play in real estate

Hey! I stumbled upon this really interesting article titled “Hayman Capital’s Kyle Bass: Taking debt out of the equation is key to a value play in real estate” and it had my brain buzzing with ideas. So basically, Kyle Bass, who’s a big shot in the investment world, is saying that if you want to make some serious cash in real estate, you gotta ditch the debt.

According to Bass, relying on debt to finance your real estate ventures is a risky move. Sure, it can give you a quick boost and allow you to snatch up some fancy properties, but it’s like building a house of cards. One wrong move, and everything can come crumbling down. It’s like playing Jenga, you know? Pull out the wrong piece, and the whole tower falls.

So what’s Bass’s alternative? Cash, baby! He believes that using your own cold, hard cash to invest in real estate is the way to go. It might sound like a no-brainer, but you’d be surprised how many people get caught up in the allure of borrowing money. Bass argues that when you use your own money, you’re in control. There’s no need to worry about interest rates skyrocketing or banks breathing down your neck.

Now, here’s where my own experience comes into the picture. A while back, I dipped my toes into the real estate market, thinking I was a genius for securing a fat loan to finance my dreams. But boy, was I wrong! As the economy took a nosedive, my beautiful investments turned into a nightmare. The interest rates shot up, and suddenly, I found myself drowning in debt. Lesson learned the hard way.

Bass’s approach, on the other hand, makes a lot of sense. By taking debt out of the equation, you’re able to make more calculated and strategic moves. You can patiently wait for the perfect opportunity, instead of snatching up anything that looks remotely promising.

To sum up, the key takeaways from Bass’s wisdom are: avoid relying on debt to finance your real estate adventures and use cash instead. By doing so, you gain control, avoid the risks associated with borrowing money, and can make more calculated investment decisions. So, if you’re thinking of diving into the real estate world, remember to leave your credit card at home and bring your piggy bank instead. Trust me, your future self will thank you for it!

Quick Links