Is California facing a home insurance crisis like hurricane-ravaged Florida?

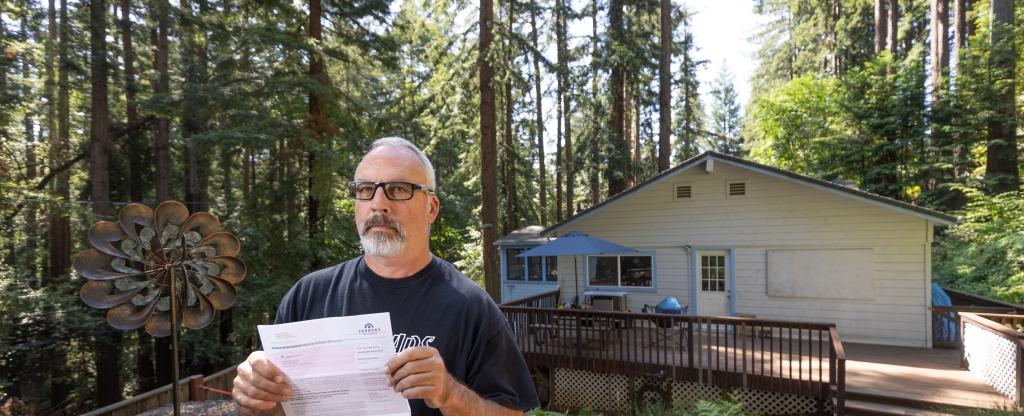

So, I just read this article called Is California facing a home insurance crisis like hurricane-ravaged Florida?, and it really got me thinking about the state of things. Basically, the article talks about how California’s recent devastating wildfires have made it more difficult for homeowners to get affordable and adequate insurance coverage. The risk of fire has increased so much that many insurance companies are leaving the market or drastically increasing rates, leaving homeowners in a bind.

According to the article, some California residents are even having to turn to the state-run insurance program, which is meant for high-risk properties and has limited coverage. This is a big deal because, as we all know, having adequate insurance coverage is crucial for protecting our homes and livelihoods. It also means that people who may not have been affected by the wildfires are still feeling the effects through increased premiums or difficulty finding coverage.

Personally, this hits close to home because my family actually lost our home in a wildfire a few years ago. We were lucky to have insurance coverage that allowed us to rebuild, but I can’t imagine what it would have been like to have to navigate an insurance crisis on top of everything else.

Overall, I think it’s really important to pay attention to issues like this and advocate for policies and solutions that help protect homeowners and communities. The effects of disasters like wildfires go beyond just the immediate damage and can have long-lasting impacts on people’s lives. So let’s stay informed and engaged!

Quick Links