Thematic Investing: How to Invest in the Next Big Idea

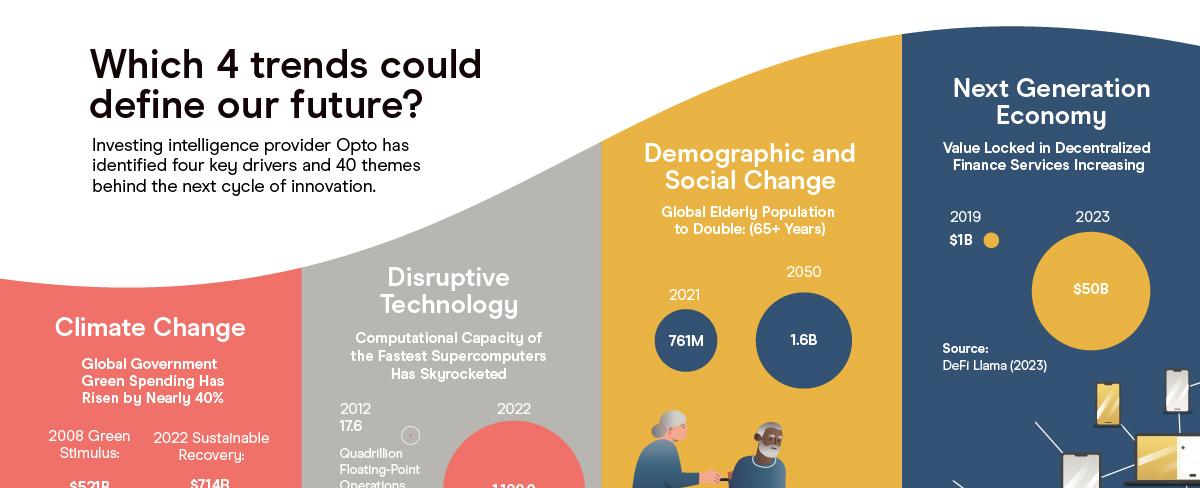

So, I stumbled upon this article about thematic investing and it was pretty interesting, my friend. It’s basically a way of investing in trends or themes that are likely to have a big impact in the near future. You know, like renewable energy, artificial intelligence, or healthcare.

The idea is that by investing in these themes, you’re betting on the future and you can potentially get a piece of the pie when they become huge.

One thing that caught my eye was that you don’t necessarily need to invest in specific companies to do this kind of investing. Instead, you can go for exchange-traded funds (ETFs) or mutual funds that focus on a particular theme.

This is pretty cool because it means you can diversify your investments across multiple companies and still stay focused on the theme you’re interested in. For example, you might not know which specific solar company is going to be the next big thing, but you can invest in a solar ETF and potentially benefit from the growth of the industry as a whole.

I remember dabbling in this a little bit a few years ago, when I invested in some biotech companies because I was fascinated by the potential for cutting-edge medical breakthroughs. Unfortunately, I didn’t do my research well enough and ended up losing some money. But now that I know about thematic investing, I might give it another shot and be more strategic about it!

Overall, I think this is a really compelling approach to investing because it’s forward-thinking and allows you to support causes and industries you believe in. Plus, who doesn’t want to be ahead of the curve and potentially reap big rewards?

Quick Links