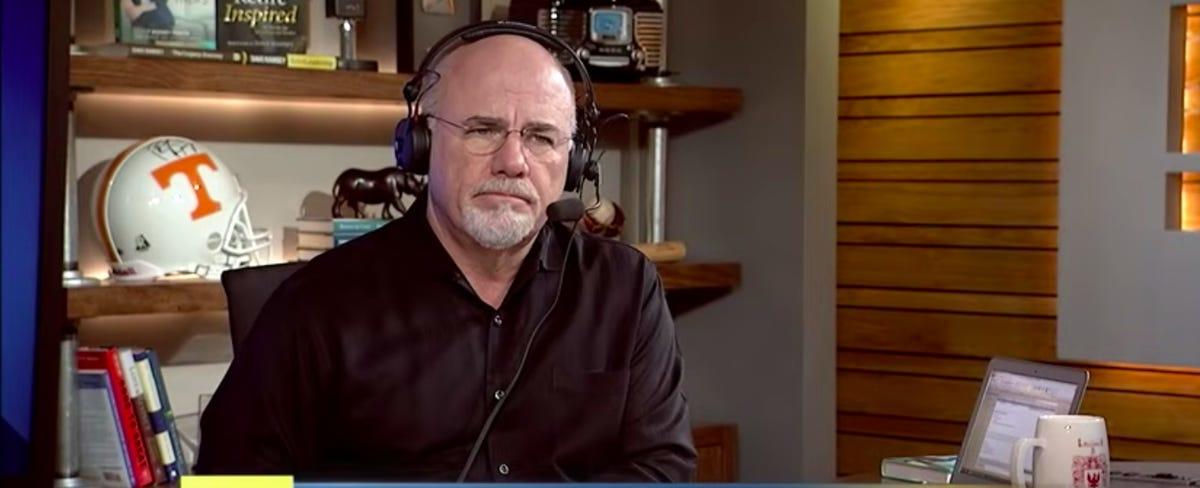

TikTok: Man Spending Half Income on Car Loan Asks Dave Ramsey to Help

So, I read this article about this guy on TikTok who is spending half of his income on his car loan and asked Dave Ramsey for help. It caught my attention because I’ve also been in a similar situation where I felt like I was drowning in debt.

Basically, this guy wanted to show off his fancy car on social media but didn’t realize the consequences of taking out such a huge loan. He ended up spending $22,000 on a car that he couldn’t afford and was struggling to make the monthly payments. When he asked Dave Ramsey for advice, he was told to sell the car and pay off the loan.

This article highlights how easy it is to get sucked into social media trends and how we often prioritize material possessions over financial stability. It’s important to recognize that buying a fancy car or taking out a massive loan doesn’t necessarily mean we’re successful or happy.

From my personal experience, I’ve learned that it’s important to understand the consequences of our financial decisions and to prioritize financial stability over short-term satisfaction. It may not be as exciting as driving around in a fancy car, but it’s crucial for our long-term financial well-being.

Overall, this article serves as a reminder that money management is a crucial aspect of our lives that we can’t afford to take lightly. We need to be accountable for our financial decisions and ensure that we’re prioritizing our future over fleeting social media moments.

Quick Links